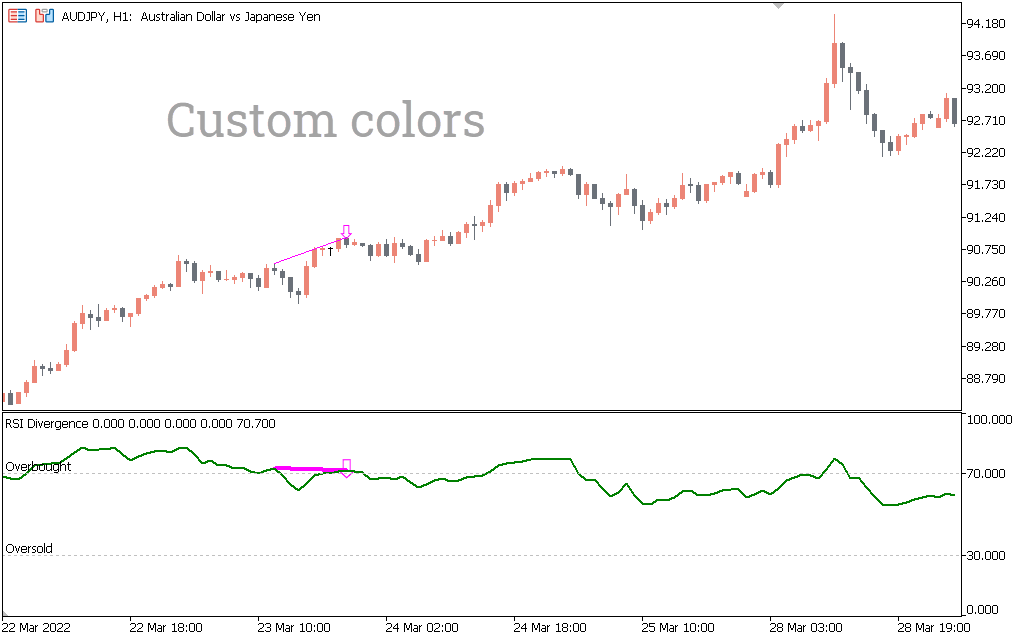

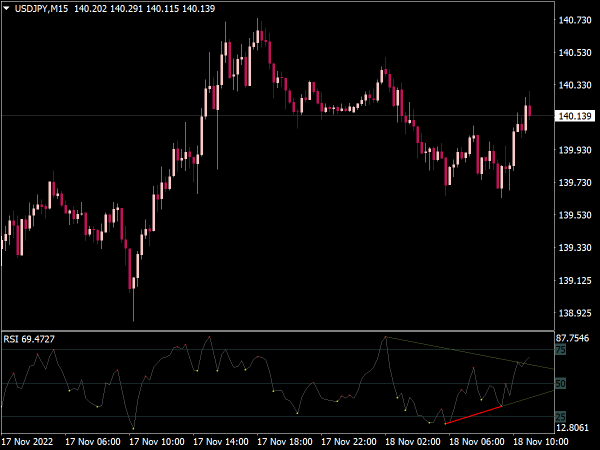

What Are The Most Important Things To Be Aware Of About Rsi Divergence Definition: RSI diversence is a technological tool used to analyze an asset’s price movement to the direction it has relative strength (RSI).

Signal: A positive RSI signal is considered a positive sign of bullishness, whereas the negative RSI deviation is thought to be bearish.

Trend Reversal: RSI Divergence can signal an inverse trend.

Confirmation: RSI divergence can be used as a confirmation tool when used in conjunction with other methods of analysis.

Timeframe: RSI divergence is possible to be observed over various timeframes in order to gain various perspectives.

Overbought/Oversold RSI numbers that exceed 70 mean overbought. Values below 30 indicate oversold.

Interpretation: In order to interpret RSI divergence properly, you need to consider other technical and fundamental factors. Follow the top

forex backtester for blog advice including crypto trading backtester, crypto trading bot, crypto backtesting, forex backtesting, trading platform crypto, automated trading software, cryptocurrency trading, RSI divergence, best trading platform, backtesting strategies and more.

What Is The Distinction Between Regular Divergence And Hidden Divergence

What Is The Distinction Between Regular Divergence And Hidden Divergence Regular Divergence: Any price change that can cause an asset to make an upper high/lower low, and the RSI to make a lower high/lower low is known as regular divergence. It could indicate a possible trend reversal, however it is important to consider the other factors that are fundamental and technical to ensure confirmation.Hidden Divergence: The hidden divergence happens when the price of an asset is lower high or a higher low while the RSI makes an upper high or lower low. Although it is a weaker indicator than regular divergence it could still be a sign of a possible trend reversal.

To be aware of technical issues:

Trend lines and levels of support/resistance

Volume levels

Moving averages

Other indicators and oscillators

It is important to remember the followingpoints:

Economic data releases

Specific news for companies

Market sentiment and indicators of sentiment

Global events and their impact on the market

Before taking decisions about investments solely based on RSI divergence indicators, you must to take into consideration both fundamental and technical aspects. Read the top rated

backtesting platform for blog advice including trading platforms, divergence trading, trading platform, online trading platform, divergence trading, forex backtesting, automated crypto trading, crypto trading, automated trading bot, automated crypto trading and more.

What Are Backtesting Trading Strategies For Trading Crypto

What Are Backtesting Trading Strategies For Trading Crypto Backtesting strategies for crypto trading is the process of simulated the implementation of a trading plan using historical data. This allows you to evaluate its potential profitability. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy Definition of the trading strategies which are being test.

Simulator: This software simulates the execution of a trading plan using historical data. This allows you to see how the strategy could have worked over time.

Metrics - Assess the strategy's performance using metrics like Sharpe Ratio, profitability drawdown, Sharpe Ratio, as well as other relevant measures.

Optimization Change the parameters of your strategy before running the simulation once more to improve the strategy's performance.

Validation: To confirm the method is reliable and doesn't overfit, test its effectiveness using data outside of the sample.

It's important to remember that past performance isn't indicative of future results, and backtesting results should not be relied upon as a guarantee of future profits. Additionally, live trading demands you to take into account the consequences of the volatility of markets as well as transaction fees and other aspects of the real world. Follow the recommended

forex backtesting software free for more info including best crypto trading platform, forex backtest software, backtesting tool, trading divergences, cryptocurrency trading, trading platform crypto, trading with divergence, backtesting tool, trading with divergence, automated cryptocurrency trading and more.

How Can You Assess The Forex Backtesting Software Used To Trade Using Divergence?

How Can You Assess The Forex Backtesting Software Used To Trade Using Divergence? These are the primary considerations when evaluating forex backtesting software that allows trading with RSI Divergence.

Flexibility: The software must permit customization and testing different RSI divergence strategies.

Metrics : The software must include a wide range of metrics that can be used to evaluate the effectiveness of RSI Divergence Trading Strategies, such as profitability, risk/reward and drawdown.

Speed: The program should be efficient and fast, allowing for quick backtesting of multiple strategies.

User-Friendliness. Even for those who have no a great deal of expertise in technical analysis it is essential that the program be easy to use.

Cost: Consider the cost of the software and decide if you can afford it.

Support: Good customer support should be offered, with tutorials and technical support.

Integration: The software has to integrate with other trading software such as charting software and trading platforms.

It is important to test the software with a demo account before committing to a paid subscription, to ensure it's suited to your specific needs and that you feel comfortable with it. View the top rated

trading with divergence for website advice including software for automated trading, backtesting trading strategies, forex trading, automated trading bot, backtesting platform, backtesting tool, backtesting trading strategies, best trading platform, automated trading platform, automated forex trading and more.

What Software For Automated Trading Function With Cryptocurrency Trading Bots?

What Software For Automated Trading Function With Cryptocurrency Trading Bots? The bots for trading cryptocurrency work within automated trading software, following an established set of rules and executing trades for the user's behalf. Here's the way it works:Trading Strategy. The user selects a trading strategy. This includes entry and withdrawal rules including position sizing, risk and management.

Integration: The trading bot integrates with the cryptocurrency exchange via APIs, allowing it to access real-time market information and to execute trades.

Algorithms analyze market data in order to make trading decisions based in part on a specific strategy.

Execution. The bot makes trades according to the trading strategy. It doesn't need manual intervention.

Monitoring: The bot continuously monitors the market and makes adjustments to the trading strategy as required.

Trading bots for cryptocurrency can be used to execute routine or complex trading strategies. This reduces the need for intervention by hand and lets users to take advantage of market opportunities 24-7. It is essential to understand that automated trading has inherent dangers. Software bugs, security vulnerabilities, and losing control over trading decisions are just some of the possible dangers. Before you can begin trading on the market, you must be sure you test thoroughly and analyze your trading robot.